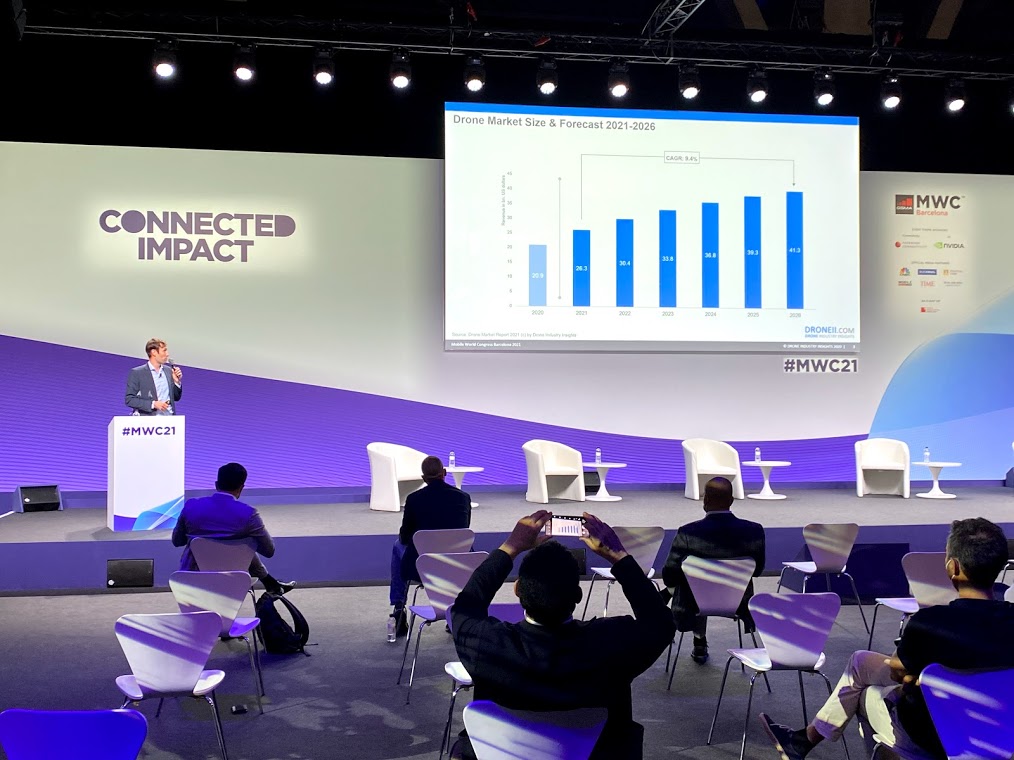

Above: Droneii CFO Hendrik Boedecker at Mobile World Congress.

14 September 2022

As the drone industry has evolved and expanded all around the globe, it has become a full-time job to track and forecast all the key information about its development. And that is what Drone Industry Insights (Droneii) built its foundations on and specializes in.

Our market research and consulting business is focused exclusively on the market for commercial drones, and our headquarters in Hamburg, Germany allows us to work with everyone from Tokyo, Japan to Los Angeles, California in our average workday.

All of this is precisely what has made our consulting projects a unique service and contribution to the drone industry, so here is a glimpse into what it is like to do market research on commercial drones and what a consulting project in this field looks like.

Market Research on Commercial Drones

One of the things that makes this industry so exciting is its niche. Working at the intersection between robotics and aviation means being at the cutting edge of technology, while also still taking every precaution to ensure human safety. Though many in the general public have only heard of drones as either small toys or military weapons, there are thousands of companies around the world doing business, facilitating processes, and optimizing workflows through drones. So, the combination of evolving technologies (e.g. better lenses, stronger batteries) and unique applications (e.g. scanning fields and structures or delivering objects) makes this a highly-dynamic market that is synonymous with innovation.

For this reason, succeeding in this market requires both expertise and a strong network. You need technical expertise in aviation and/or robotics to understand what is and isn’t feasible (or allowed), and you need a network of experts to stay on top of how drones are being used for business all around the globe.

This is what Drone Industry Insights has been doing since its beginning in 2015. Our founders both have a background and long history in aviation, and they developed contacts within the drone industry from the early days of drone technology. So, as the industry has evolved, we have been able to create and update our databases with the information necessary to stay on top of the latest developments. And this leads to another crucial aspect of Droneii’s methodology: Having a bottom-up approach.

It is impossible to do market research and truly understand the drone industry by looking exclusively or even primarily at broad global market numbers. This is, of course, something we provide in our market reports, but our numbers are derived bottom-up rather than top-down.

Instead of starting at the top with total global or regional addressable markets and working under those assumptions, our approach uses different sources from the bottom as a basic foundation. This means we see what companies are actually doing in terms of application methods, target industries, and revenue, and we use this to build up various forecasts of the serviceable market of each industry vertical, country and region.

We also look at what is happening with regulation in each country as well as investments and even individual companies or rising technologies. This is what we then use to create a forecast for where the commercial market may be headed, and we revise and update this information throughout the year, every year.

Droneii CEO Kay Wackwitz at ILA.

Consulting Projects for Commercial Drones

This leads directly to our consulting work, where someone reaches out to us in search of specific information about some part of the market or about a company they are looking to invest in. Ideally, the company or individual reaching out to us knows exactly what information they seek as well as what they want to do with it, but of course there are plenty of times when there’s a need to discuss and help our clients figure out exactly what they need to help their business. In the end, the core aspect of this service is actionable data.

What exactly is this actionable data that the consulting projects yield? The simplest explanation boils down to context: the data that from a consulting project needs to be put into context to solve the clients’ problem. Sometimes this problem is finding competitors or profitability to determine if market entry or a particular business model is indeed worthwhile. Other times, the problem is deciding whether to invest in a [drone] company (due-diligence) or for a drone company to build their portfolio before seeking investments, strengthen their pitch decks, revise their business plans etc.

Among the various components of actionable data is the well-known SWOT (Strengths, Weaknesses, Opportunities, Threats) Analysis. This analysis is a good way to place the focus point of project into a larger context, and it requires a deep understanding of both the individual and the bigger picture. It’s impossible to determine a strength or weakness if you don’t understand how a company compares to others on the market. And this is precisely what brings us back to the need for both expertise and a network. Both of these are indispensable for placing the individual company into a context that highlights its strengths and weaknesses when compared to others on the market, but especially the opportunities and threats for its business model.

Wackwitz at Japan Drone.

Sample Consulting Projects

One type of consulting project that has gained traction and is particularly interesting are the country market studies. Over the past few years, we have carried out a bespoke market study on the German drone market (twice), the Swiss drone market, and the upcoming Norwegian drone market. During these projects, we have been approached by drone associations of the respective countries, who then acquired the funding to finance the project after we had agreed on a scope, budget, and timing. We then carry out a survey, conduct interviews, analyze results, and combine it with our proprietary data that we had on that country. All of this goes back to our bottom-up approach, which ensures that we hear directly from drone companies as much as possible while also factoring in regional and global market trends.

It’s crucial to note that there really aren’t good alternatives for this type of in-depth research. Someone might be tempted to carry out basic market research on these countries by taking data about the global drone market, extrapolating some info (such as the CAGR, etc) and using some sort of generic metric like GDP to single out a country from the overall data. But this method would not factor in any nuances of specific countries or their individual drone market developments, nor would it really be accurate. In the end this non-professional method brings much more harm than benefit and it can be very costly not only in terms of credibility, but also financially (if decisions are made from this data), so we strongly advise against it.

Another common type of consulting project is for example our work for Quantum Systems. Drone Industry Insights supported the investors of Quantum Systems in several investment rounds by providing commercial due diligence. The project provided crucial intel about the drone environment alongside an assessment of the company’s portfolio and a risk assessment. This resulted in a clear analysis of the company’s market potential, which included the aforementioned SWOT analysis that was complemented by a competitive analysis between Quantum Systems and big market players as well as other types of competitors and challenges. Today the company has raised more than US$40 Million, most-recently with an extended Series-A of US$32 million and is today one of the leading VTOL-fixed-wing manufacturers in the world.

The Drone Market and its Future

Based on our most recent market update, the global drone market is forecast to generate US$55.8 billion by 2030, growing at a compound annual growth rate (CAGR) of 7.8%. To some, this might seem like an easy or simple forecast to make, but there is a lot of work that goes behind that. On the one hand, tracking the effects of the pandemic as well as a slow-moving regulatory environment made us revise our figure for the CAGR from previous years (13.8% in 2020 and 9.4% in 2021). On the other hand, a Google search can show that some project the market to grow at a CAGR of anywhere between 28.6% and 57.5%, which is either extremely optimistic or it assumes the global drone market is much smaller than it actually is (and therefore even moderate growth would translate into such large percentages). So these simple-looking market numbers require good data as a foundation and solid market models to forecast growth. It is not simply a matter of placing a bet, hoping you are right, and risking your entire business if you are not.

As if the market data were not enough, there is a lot of activity happening every year around the world in terms of drone regulation and investments. Both of these have a strong impact on market models and the pace at which the industry can grow. In particular, the topic of investments brings us full-circle back to the consulting work that we do. The drone industry is still very startup-driven, and it costs considerable money for companies to hire engineers, buy and develop robotic parts, test their products and market their USP to the right audience. Many companies need substantial investments to achieve this, but not every company has the same market potential and not every country’s market offers the same opportunities. That is why it is becoming increasingly more important for investors to perform due diligence before deciding how much money to put into which companies. It benefits the investors, it helps the right companies, and it drives the global industry forward.

Droneii team office.